Many crypto investors want to know: Is it possible to withdraw cryptocurrency without paying taxes? The short answer is: You generally can’t avoid taxes entirely when you cash out crypto, but there are legal ways to minimize or defer your tax burden.

This guide breaks down exactly when crypto withdrawals trigger taxes, what counts as taxable events, and 6 practical strategies to reduce or legally avoid paying taxes when withdrawing your crypto.

Understanding Crypto Taxation: The Basics

Most countries treat cryptocurrency as property. This classification means any conversion of crypto to fiat, or using it to buy goods or services, may be a taxable event. You are typically taxed on the capital gain—the difference between your buy price (cost basis) and the price at the time of withdrawal.

Example:

- Bought ETH at $2,000

- Sold ETH at $3,500

- Taxable capital gain: $1,500

Knowing when and how tax events are triggered is the foundation of effective tax strategy.

What Is a Crypto Withdrawal?

A crypto withdrawal typically means moving crypto from an exchange to a personal wallet, or converting USDT to USD or another asset. It’s important to distinguish between a wallet withdrawal (not taxable) and a conversion or sale (potentially taxable).

When Does Crypto Become Taxable?

Crypto is considered property by the IRS and many global tax agencies. Events that create tax liabilities include:

- Selling crypto for fiat

- Trading one crypto for another

- Using crypto to buy goods/services

- Earning crypto via mining, staking, or airdrops

Which Crypto Transactions Are Not Taxable?

Not all crypto activity triggers a tax event. Examples of non-taxable events include:

- Transferring crypto between the wallets you own

- Buying and holding crypto

- Donating crypto to qualified charities (with deductions possible)

6 Ways to Withdraw Crypto Without Paying Taxes (Legally)

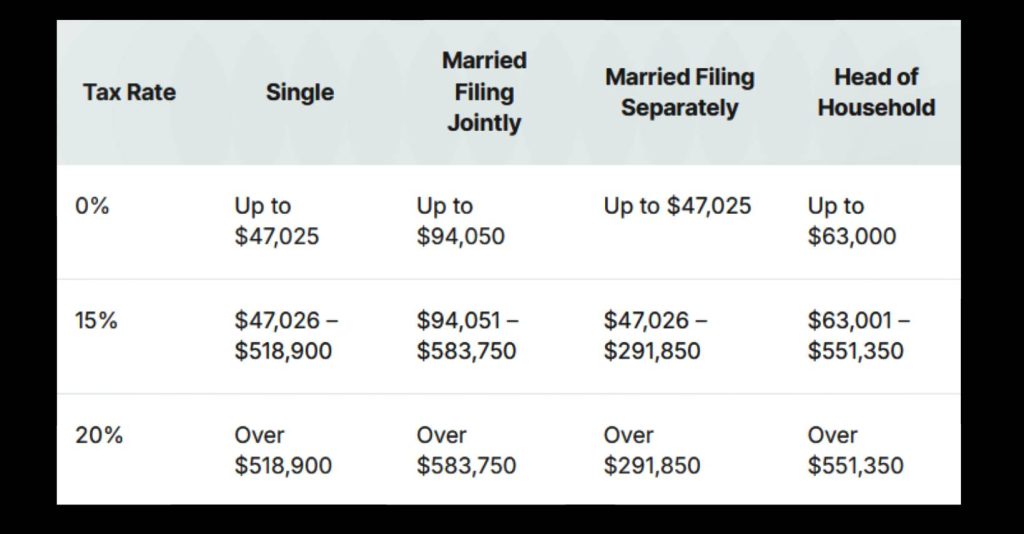

1. Hold Your Crypto for Over One Year

Selling cryptocurrency after holding it for more than 12 months qualifies for long-term capital gains tax rates, which can be as low as 0% for lower-income brackets. This significantly reduces your tax bill compared to short-term rates.

2. Sell Losing Crypto to Reduce Taxable Gains

Selling some cryptocurrency at a loss allows you to offset gains on other investments, thereby lowering your total taxable income. You can also deduct up to $3,000 in losses against ordinary income per year, and carry forward unused losses.

3. Use a Crypto IRA (Self-Directed Retirement Account)

Investing in a crypto IRA allows your earnings to grow tax-deferred or tax-free (depending on the account type). Withdrawals during retirement may be taxed at lower rates or not at all.

4. Borrow Against Your Crypto

Taking a crypto-backed loan lets you access cash without selling your assets, avoiding a taxable event. Be aware of loan terms and risks like liquidation.

5. Gift or Donate Crypto

You can gift up to $18,000 (2024 limit) per person annually without triggering taxes, or donate crypto to a qualified charity to avoid capital gains and potentially get a tax deduction.

6. Move to a Low-Tax State or Country

Some U.S. states, like Florida and Texas, have no income tax. Certain countries (UAE, Portugal, Malta) don’t tax crypto gains, so establishing residency there can reduce or eliminate your tax liability.

How Is Crypto Taxed in the US?

- Capital Gains Tax: You pay tax on profits when you sell or swap bitcoin, not on the withdrawal amount itself.

- Short-Term: Holding crypto less than 12 months means paying higher short-term rates (up to 37%).

- Long-Term: Over 12 months, long-term rates (0-20%) apply.

- Income Tax: Applies to mining rewards, staking income, airdrops, or crypto earned as payment.

Reporting Your Crypto Taxes

1. Steps to Report Crypto on Taxes:

- Use crypto tax software (e.g., CoinTracker, Koinly)

- Import your transaction history from all wallets and exchanges

- Generate IRS forms (8949, Schedule D)

- Report crypto income (staking, airdrops) on Schedule 1 or Schedule C

2. Best Way to Do Crypto Taxes

- Use professional tax software tailored for crypto

- Work with a CPA experienced in digital assets

- Maintain records of every transaction: date, cost basis, sale value, and fees

3. Important Changes to Crypto Tax Rules in 2025

- Broker reporting mandates begin: 1099-DA forms

- Tighter KYC enforcement for exchanges and DeFi platforms

- Increased penalties for failure to disclose crypto holdings

Stay ahead by adjusting your strategies early and maintaining transparent records.

Final Thoughts

While there is no legal way to completely avoid taxes when withdrawing crypto, by holding long-term, harvesting losses, using crypto IRAs, borrowing, gifting, or relocating, you can significantly reduce your tax burden.

At DeFi Crypto Wallets, we provide the latest guidance and tools to help you manage your crypto taxes confidently and legally.

FAQs:

Is transferring crypto to my own wallet taxable?

No. Transferring crypto between wallets you own is not a taxable event because you’re not disposing of the asset.

What is the best way to cash out crypto tax-free in the U.S.?

Consider holding crypto for over 12 months, using a Roth IRA, or relocating to a state with no income tax, like Texas or Florida.

Does borrowing against crypto trigger taxes?

No. Loans are not taxable because you’re not selling your assets. However, there is liquidation risk if the asset value drops.

What countries have no crypto tax?

Countries like the UAE, Portugal, and Germany (under specific conditions) offer zero or low taxes on crypto for individual investors.